Inbanx

250

Web, iOS

5x

Inbanx – Smarter Expense Management for Growing Businesses

Project Overview

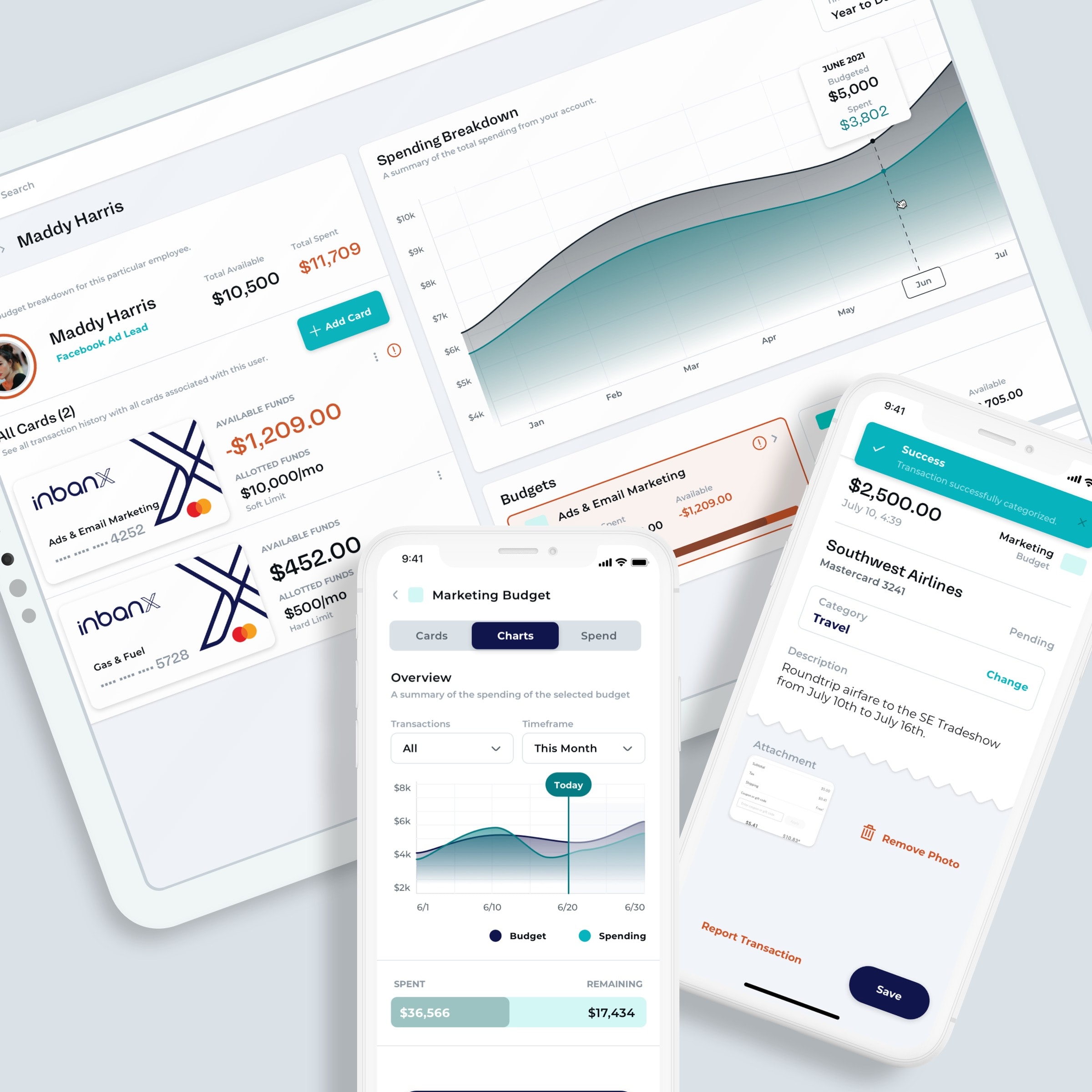

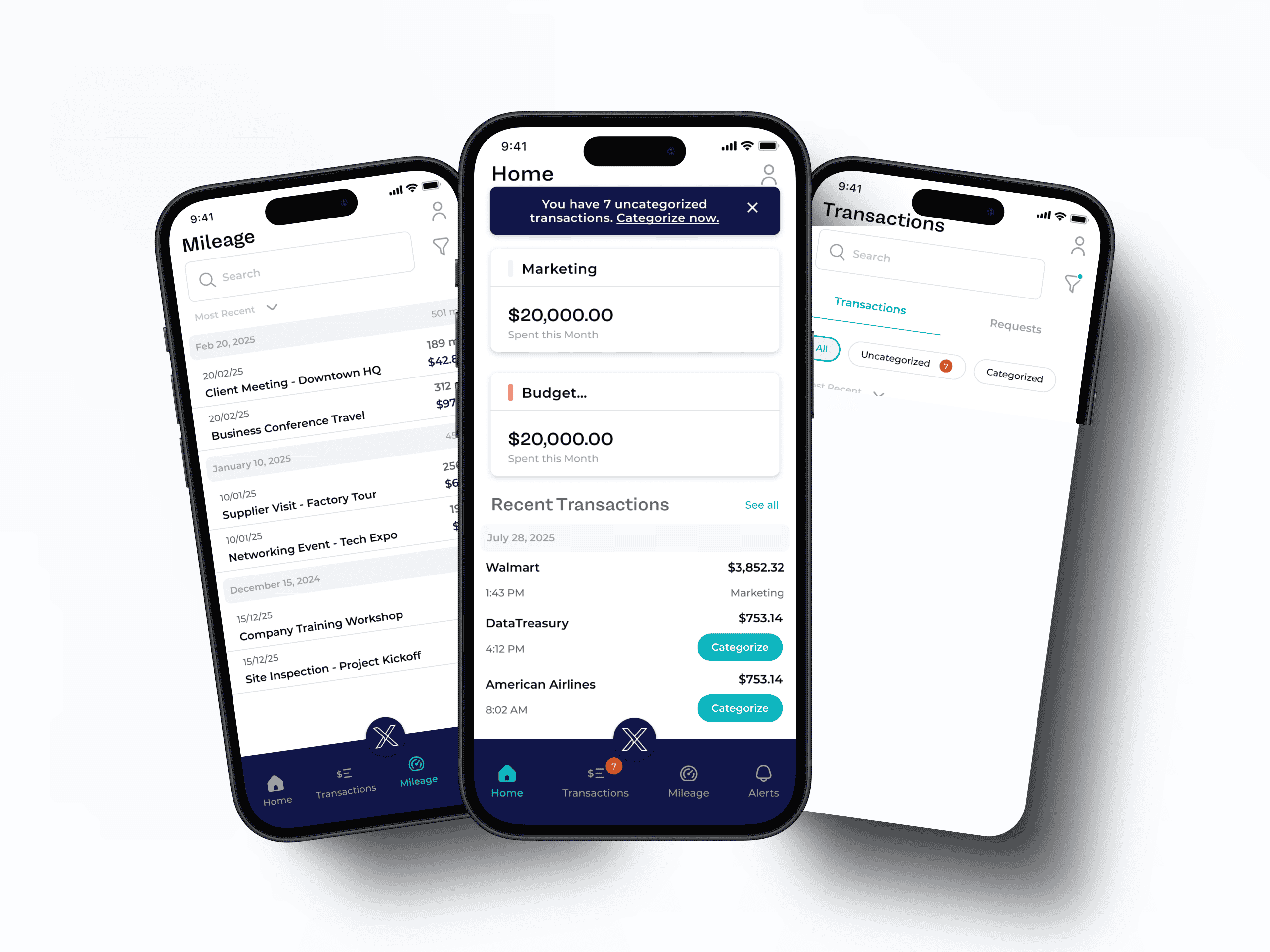

Inbanx is a modern SaaS platform built to streamline expense management for small to medium-sized businesses. It offers a robust yet intuitive suite of features—from budget and sub-budget creation to corporate card issuance, mileage tracking, reimbursements, and real-time expense monitoring. The goal: make financial oversight more accessible, less bloated, and easier to implement than traditional corporate finance software.

250

Web, iOS

5x

Problem Statement

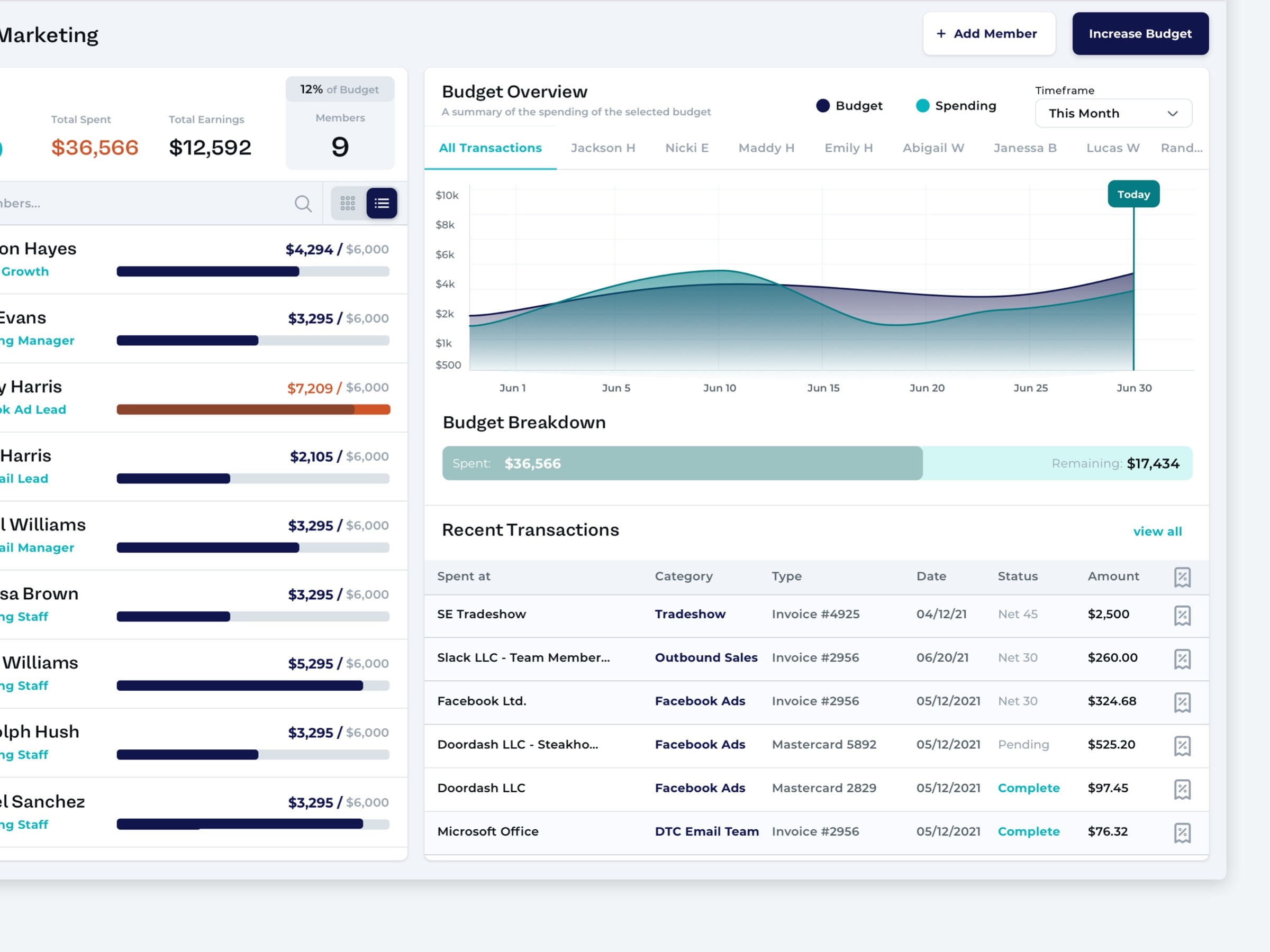

From that rough idea, we had to come up with the full experience for three different user types. We knew that for the product to work we needed at least three user types, an organization which would be the customer of Inbanx, then an Org. Admin or Manager and then individual spenders. Coming up with the structure needed in order to connect funding accounts, distribute funds to teams within Budgets and monitor spend within those teams is quite the challenge.

We started the project like any other: in Discovery. During discovery we sat down with the Inbanx Team, we talked through the variety of features that were on the table and we helped them streamline what an MVP should look like so that we could prove the concept out in development.

Design Augmentation --> Solution Delivered

Our team partnered with Inbanx to deliver a full cross-platform design system for both mobile and desktop applications. We ensured a cohesive user experience across devices while accounting for the nuanced workflows of finance teams, administrators, and employees submitting expenses on the go.

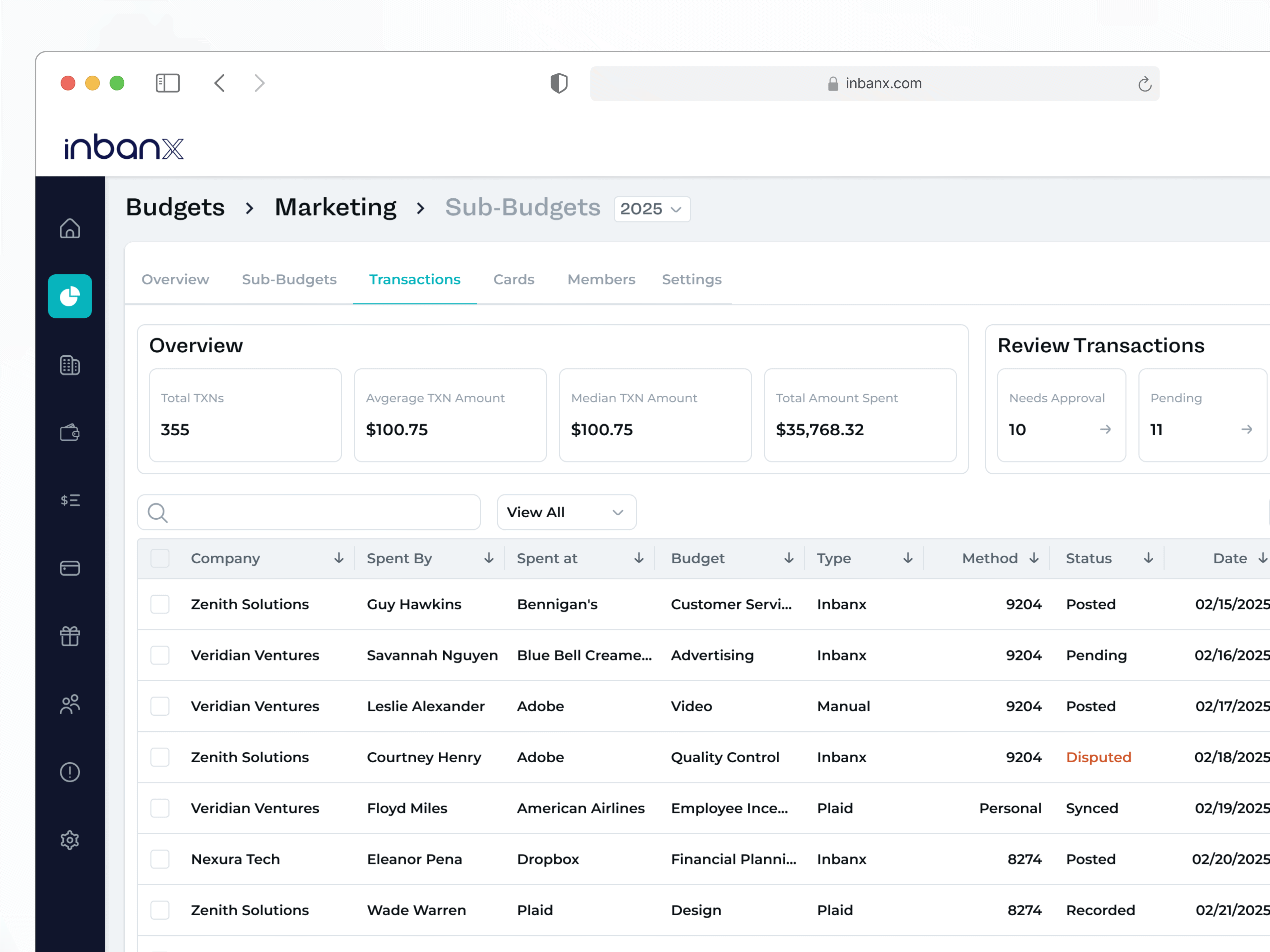

Core UX Framework for Transactions, Budgets & Controls

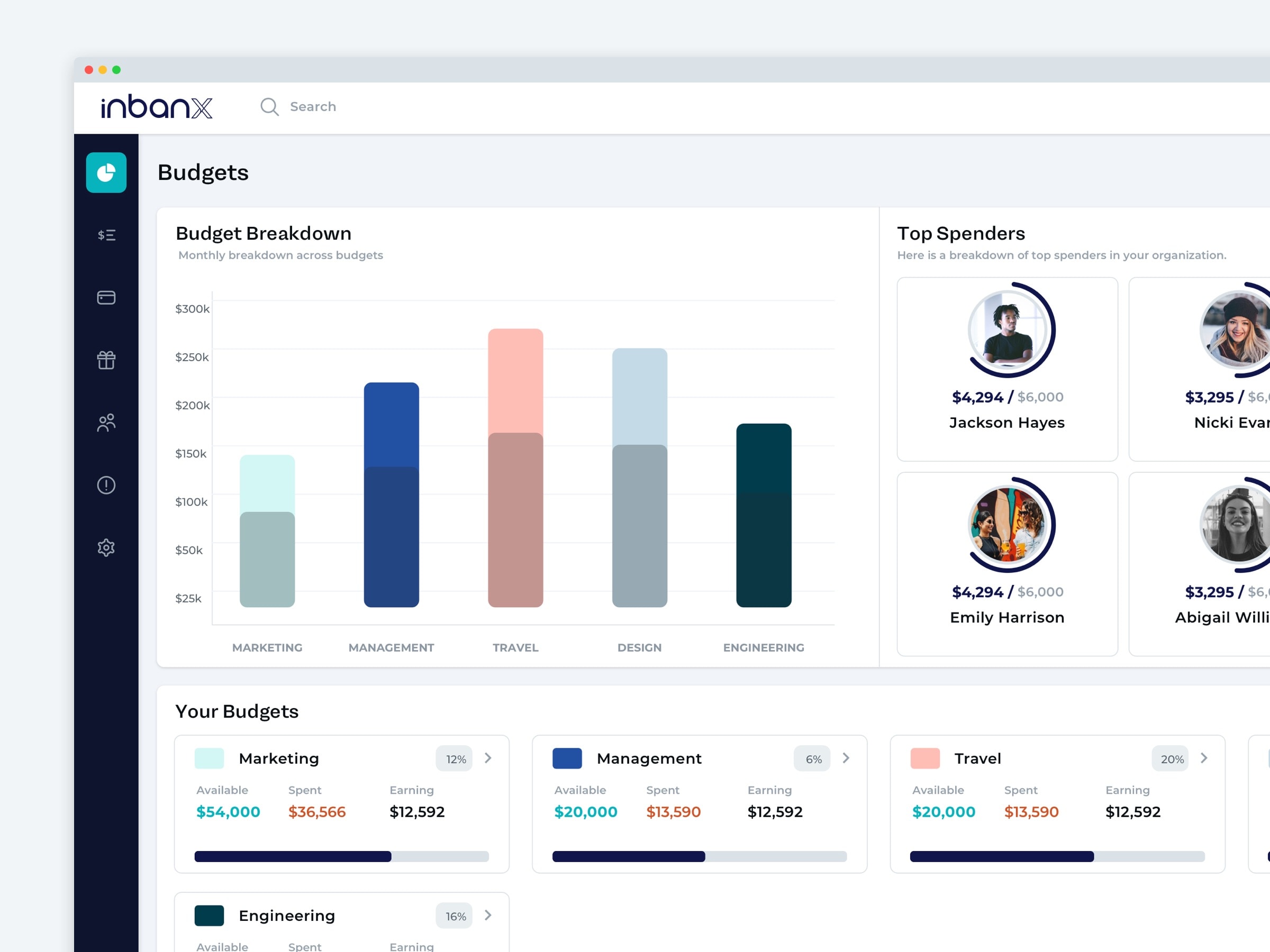

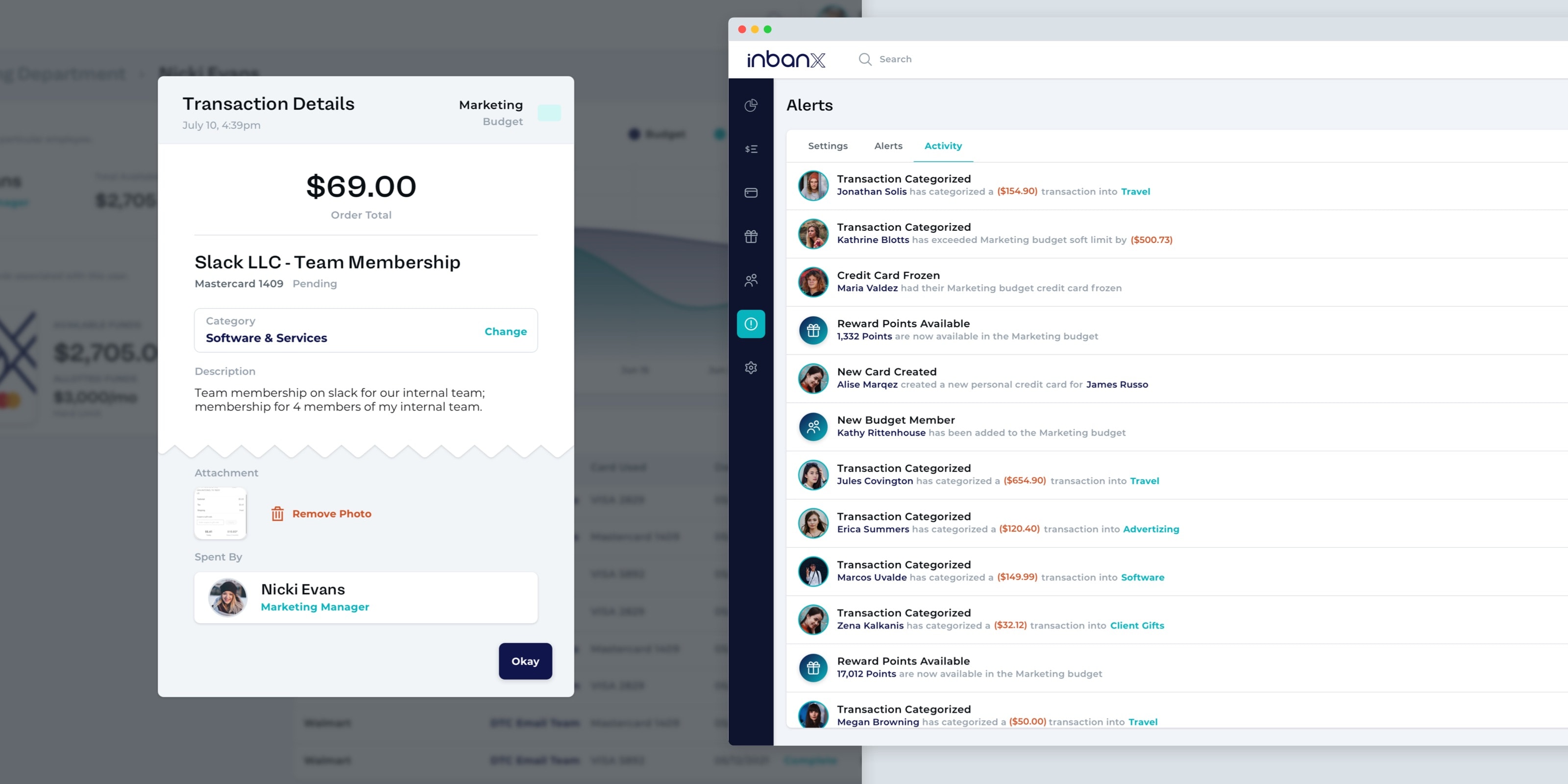

We began by mapping the core product experience: setting up budgets, creating sub-budgets for teams or departments, issuing cards with controls, and managing reimbursements. Each flow was reimagined to reduce friction and empower non-finance users to complete tasks confidently. We designed flexible components for recurring expenses, policy alerts, and approval workflows, ensuring the product worked for both startups and larger teams.

Special care was given to the budget interface. We broke down complex financial hierarchies into visual, modular cards that could be expanded or collapsed as needed—making it easy to understand spend at a glance. Real-time sync with third-party transaction data added another layer of complexity, so we introduced pattern-matching UI states to help users identify anomalies or mismatched records without confusion.

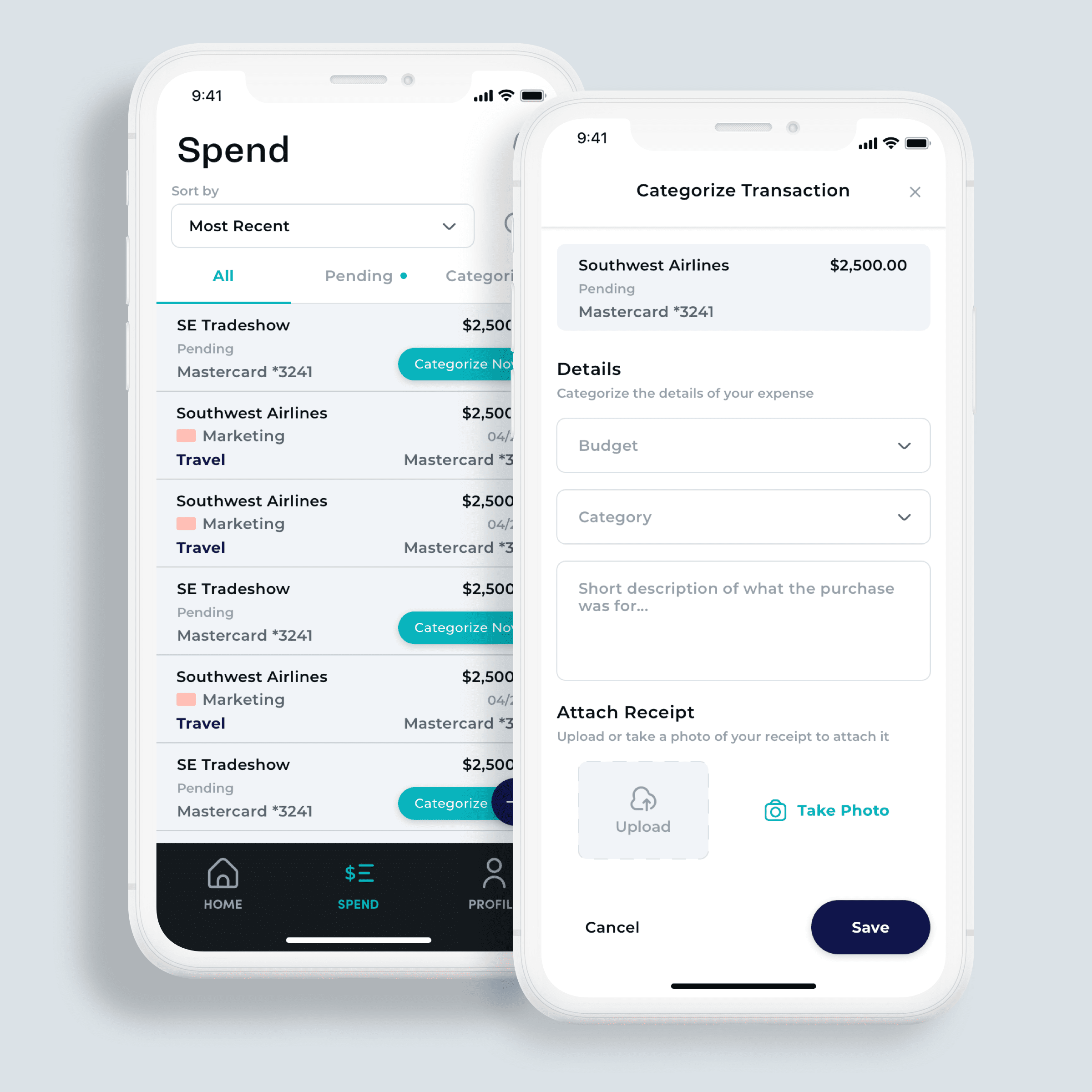

Navigating Third-Party Constraints with Smart Design

Rather than seeing third-party limitations as blockers, we used them as design constraints that sparked innovation. Certain features—like auto-categorizing transactions or customizing mileage rates—had to be designed around rigid API structures. We responded by building layered UX patterns that gave users control and transparency, even when the system was working behind the scenes.

We also developed components that anticipated scalability: bulk actions, flexible permission settings, customizable alerts, and mobile-first interfaces for field-based employees. These additions ensured that as Inbanx grows, the product won’t need to be re-architected—it’s already designed with growth in mind.

Partnerships Build Trust

We helped Inbanx (and continue to help them) build out the entire product for their MVP and beyond. We are working with them on strategy, direction and implementing best practices for the use cases they are developing.

Start a project